FAQ

Want to have a more thorough understanding of ACA and its working? Here are the most frequently asked questions about how ACA changes things.

Want to have a more thorough understanding of ACA and its working? Here are the most frequently asked questions about how ACA changes things.

If you can answer yes to all of these questions, you may be eligible for the premium tax credit.

To get your tax credit, you'll first need to fill out an application on the Health Insurance Marketplace. Then you'll get an estimate of the amount of credit you can claim for the coming year. The amount of credit you can get is based on:

The larger your family is and the lower your income, the more credit you may be eligible for.

Then, you'll decide how to use your credit. You can use the Advanced Premium Tax Credit and choose to have all or some of it paid in advance toward your premium. The Marketplace notifies your insurance company about your credit, and reimburses them. Your insurance company applies the credit to your premium each month, so your payments are lower.

You can also wait to claim your credit when you file your tax return for the year you were covered by your plan. If you only applied part of it to your premium, you can claim the unused portion when you file, too. It's the difference between getting the credit as a lump sum, or paying less in premiums each month. The choice is yours.

Because it's based on your family size and income, your Advanced Premium Tax Credit changes as your life changes during a year. Events that affect the amount

Did you choose to have some or all of your credit applied in advance to your monthly premium? You should notify the Health Insurance Marketplace about any of these changes. They'll update the information first used to determine your premium tax credit. Then they'll adjust your advance payment amount.

You'll need to file a federal income tax return if:

During the year, advance credit payments in any amount were applied to your premium.

You decided to wait to claim the premium tax credit at the end of the tax year.

You received Form 1095- (A) from the Health Insurance Marketplace. You’ll get the statement each year by Jan. 31st. It will show the amount of your premiums and advance credit payments paid.

You'll use this to see if there are any differences between:

The amount of advance payments applied to your premium based on the information you gave the Marketplace.

The tax credit amount you're actually due based on what you report on your tax return.

The actual premium tax credit on your tax return and the advance credit payments you received during the tax year; the difference will be subtracted from your refund or added to your balance due.

The premium tax credit amount on your return is more than your advance credit payments; the difference will be added to your refund or subtracted from your balance due.

Whether you take advance payments or wait to claim your credit, this subsidy is a refundable credit. That means if the amount of your credit is more than what you owe in taxes, you'll receive the difference as a refund. If you owe no tax, the credit will be added to increase the amount of your refund.

Under the ACA the Cost Sharing Reduction subsidies reduce the out-of-pocket costs you pay during a policy period (usually a year) for health care services you receive. It includes your deductible, coinsurance and copays, which all add up to your out-of-pocket maximum.

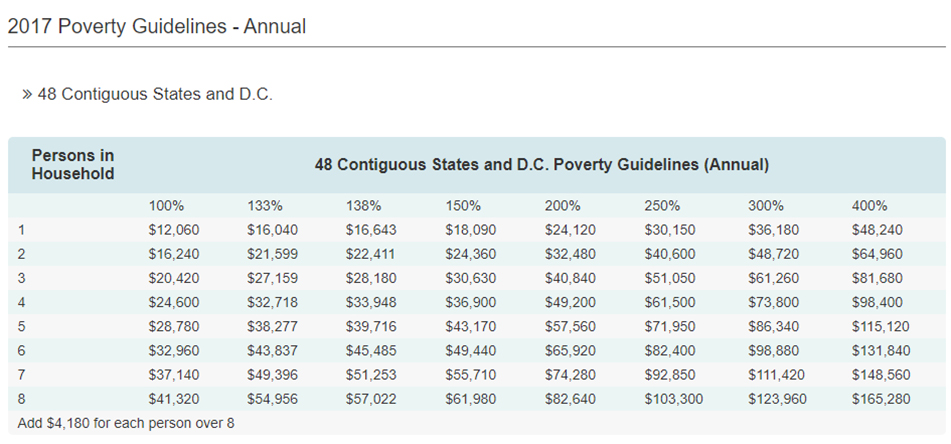

You may qualify for these subsidies to help pay for your health insurance if your total Modified Adjusted Gross Income (or MAGI) is between 100% and 400% of the Federal Poverty Level (or FPL) and you meet these requirements:

The larger your family is and the lower your income, the more credit you may be eligible for.

These subsidies are set on a sliding scale so that what you spend each month is limited to a defined percentage of your income, adjusted to the second least-expensive silver-level plan available in your area. Subsidies can only be determined by the governing body in your state. If you get a subsidy, you'll have to report it when you send in your taxes. When it's time to file your taxes, you'll get a 1095 form with all the necessary information.

The main factor is your income. You can qualify for a subsidy if you make up to four times the Federal Poverty Level. That's about $48,240 for an individual and $98,400 for a family of four. If you're an individual who makes about $29,000 or less, or a family of four that makes about $60,000 or less, you may qualify for both subsidies.

While ACA has come with significant changes in the general health insurance ecosystem, there are only two ways with which it changes your Health Savings Account dynamic.

Any taxpayer who obtained their health insurance through a federal or state exchange (Marketplace) will receive Form 1095-A (Health Insurance Marketplace Statement) in the mail by January 31st. The information on this form will be used to calculate the Premium Tax Credit, especially if you received assistance in paying for your health insurance premiums (advance premium tax credit).

Since this information return looks very different from a W-2 or 1099 that you are used to receiving, you will need to understand what Form 1095-A is for and the importance of bringing it with you when filing your federal income tax return.

If you lose the Form 1095-A, a copy may be obtained from the Marketplace where you received your health insurance.

The Form 1095-A (Health Insurance Marketplace Statement) will show you the following information:

Advance premium tax credit (subsidy) you received (if any) to help pay for your monthly premiums. This is shown by month in Part III along with the total for the year.

The information reported in Part III will be used to complete Form 8962 (Premium Tax Credit), Part 2(Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit).

Health insurance coverage information includes a list of all members of the household who were covered.

Affordable Care Act (ACA) – ATC Tax Pros can help you retrieve & file Form 1095-A

Learn More

Subscribe to our free newsletter and receive the latest updates.

Your information will not be published.

This message is only visible to admins:

Unable to display Facebook posts