The Affordable Care Act, or Obamacare, is a law that aims to reform America’s healthcare. The law primarily deals with:

- Improving the affordability and quality of health insurance

- Changing how we deal with chronic diseases

- Reforming healthcare delivery

- Strengthening the country’s primary care systems

Studies show that the total number of uninsured Americans has shrunk since Obamacare came into effect. In fact, a Gallup health insurance pollfound that there has been a 3.7 percent point decline in the number of adults who are uninsured since the last quarter of 2013.

However, skeptics say that this is nowhere near the reduction in the number of uninsured that we were promised. Other surveys have found that an overwhelming number of people didn’t sign up for Obamacare because they simply didn’t understand it. Looking at the Act’s reforms, premium tax credits, and cost-sharing reductions, people were confused about what Obamacare could do for them. And they still are. An income tax service provider can explain the ACA in detail, but it doesn’t hurt to read up on it anyway.

Here, we’ll run you through a brief summary of the reforms put into place by Obamacare:

What Are Tax Credits?

The Affordable Care Act ensures that low-cost health insurance is easily accessible to every American, by offering them government-sponsored health insurance plans at discount. These discounted plans are known as tax credits.

Those who qualify for tax credits have income which ranges from one to four times the Federal Poverty Level. If you do qualify, you’re given the option to either declare the credits on your yearly tax return or reduce your monthly insurance bill by applying the credits to your premiums.

The Plans

Everyone doesn’t get the same health insurance plan under Obamacare. Each plan falls into a tier that corresponds to a specific metal – bronze, silver, gold and platinum. Bronze is the cheapest, but these plans will only cover 40% of your costs. Platinum is the most expensive, but 90% of your costs will be covered.

Here’s a little tip – if your income is between 1 and 2.5 times the Federal Poverty Limit, choose a Silver plan that will cover 70% of your costs. You will automatically be upgraded to a Gold plan that covers 80%, free of any extra charge.

Changing the Game for Insurance Companies

You won’t qualify for credits if your income isn’t within one to four times the FPL range, but that doesn’t mean that you don’t stand to gain anything from the Affordable Care Act. Under Obamacare, insurance companies have to play by different rules. They are no longer allowed to turn you away, drop you, or add a lot of extra zeros to the cost of your coverage because you have a preexisting medical condition.

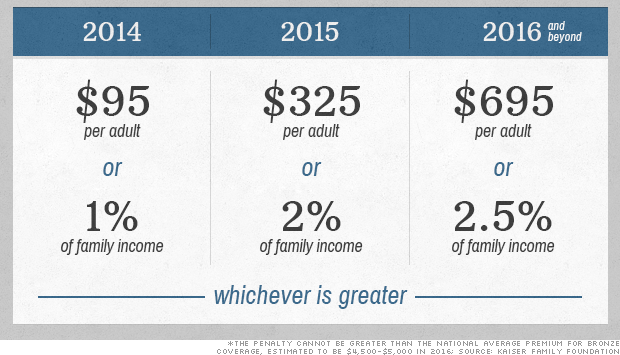

Obamacare Penalties and Why You Should Care About Them

Some would say that the Act is designed to help people find the kind of health insurance plan that is perfect for them, and that it protects them from being swindled by insurance companies. Others argue that the Act strong-arms people into signing up. Now that you have the facts, you can make up your own mind.

The post What You Need To Know About The Affordable Care Act appeared first on .